When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now. You may hear one thing in conversation with your friends, see something totally different on the news, and read something on social media that contradicts both of those thoughts. And, if you’re thinking about making a move, that can leave you with a lot of lingering questions. That’s where a trusted local real estate agent comes in.

Here are the top 3 questions people are asking about today’s housing market, and the data to help answer them.

1. What’s Next for Mortgage Rates?

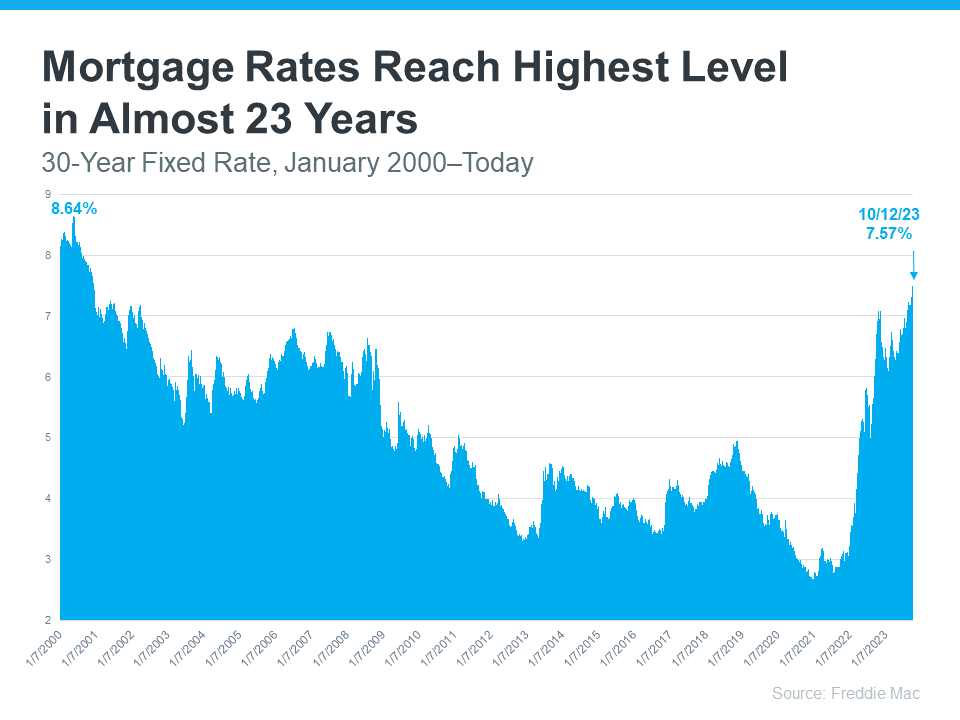

Mortgage rates are higher than they’ve been in recent years. And, if you’re looking to buy a home, that impacts how much you can afford. That’s why so many buyers want to know what’s ahead for mortgage rates. The answer to that question is: no one can say for certain, but here’s what we know based on historical trends.

There’s a long-standing relationship between mortgage rates and inflation. Basically, when inflation is high, mortgage rates tend to follow suit. Over the past year, inflation was up, so mortgage rates were as well. But inflation is easing now. And this is why the Federal Reserve has recently paused their federal funds rate hikes, which means many experts believe mortgage rates will begin to come down.

And in some ways, we’ve started to see hints of slightly lower mortgage rates in recent weeks. But it’s certainly been volatile and will likely continue to be that way going into next year. Some ongoing variation is to be expected, but the anticipation is, that in 2024, we’ll see a downward trend. As Aziz Sunderji, Strategist at Home Economics, says:

“The bottom line is that interest rates are likely to be lower-perhaps even lower than many optimists think – in the weeks and months to come.”

2. Where Are Home Prices Headed?

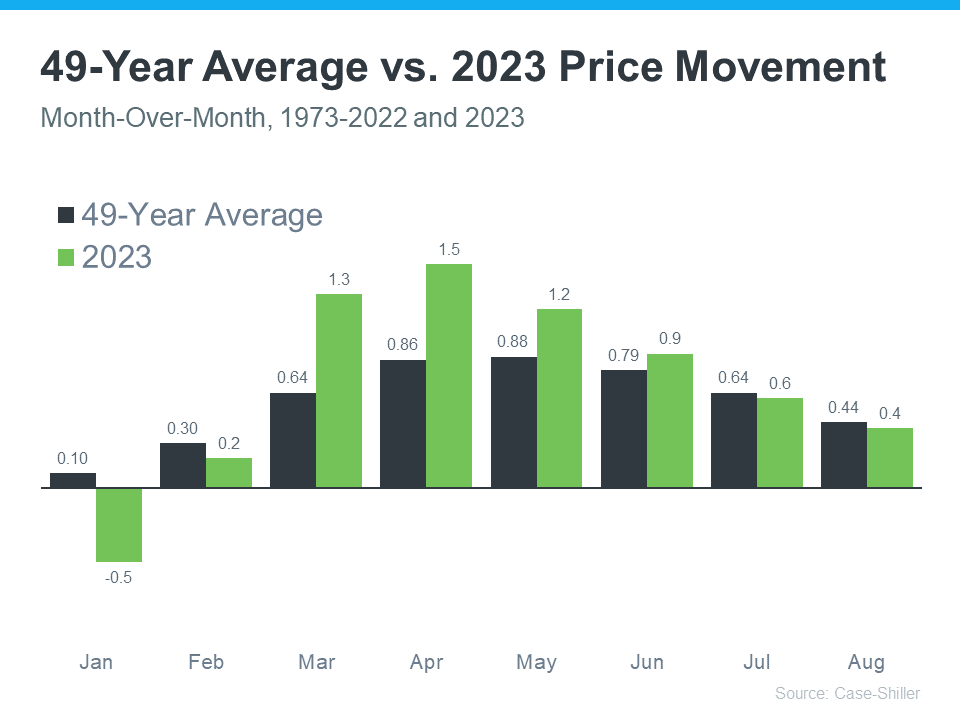

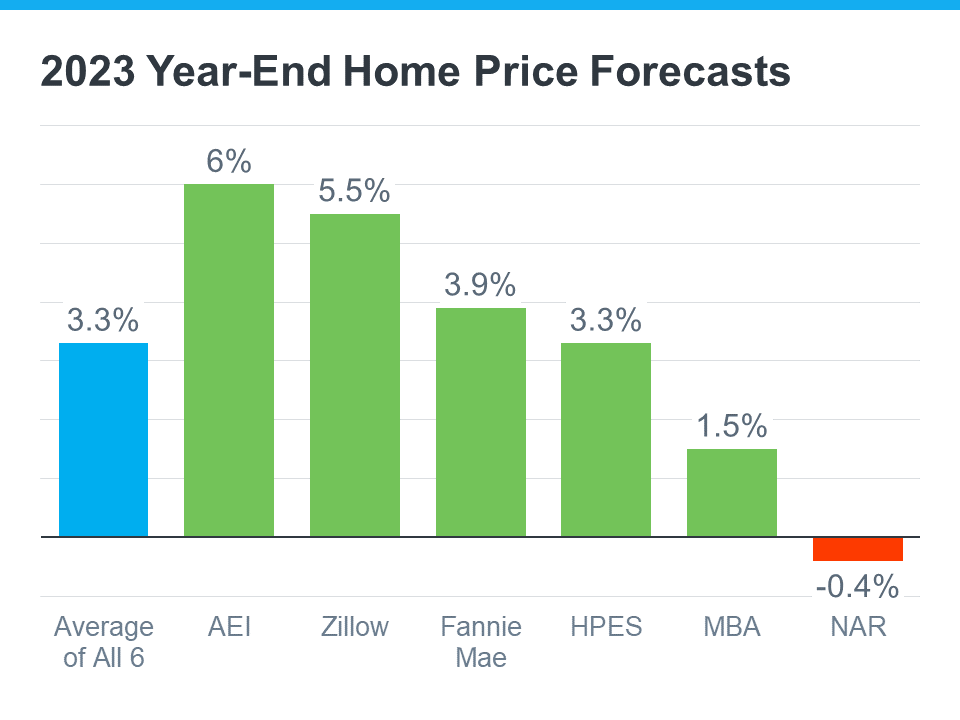

While there’s been a lot of concern prices would come crashing down this year, data shows that didn’t happen. In fact, home prices are rising in most of the nation. Experts say that trend will continue, just at a slower pace that’s much more normal for the housing market – and that’s a good thing.

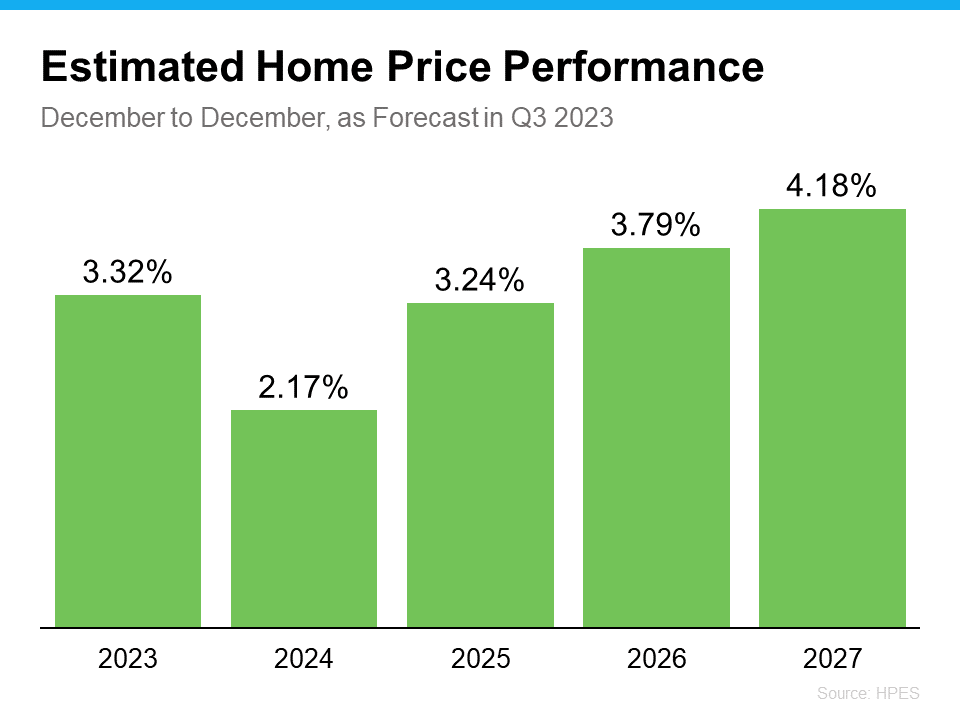

To help show just how confident experts are in this continued appreciation, take a look at the Home Price Expectation Survey from Pulsenomics. It’s a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists. As the graph below shows, the consensus is, that prices will keep climbing next year, and in the years to come.

3. Is a Recession Around the Corner?

While recession talk has been a common thing over the past few years, there’s good news on that front.

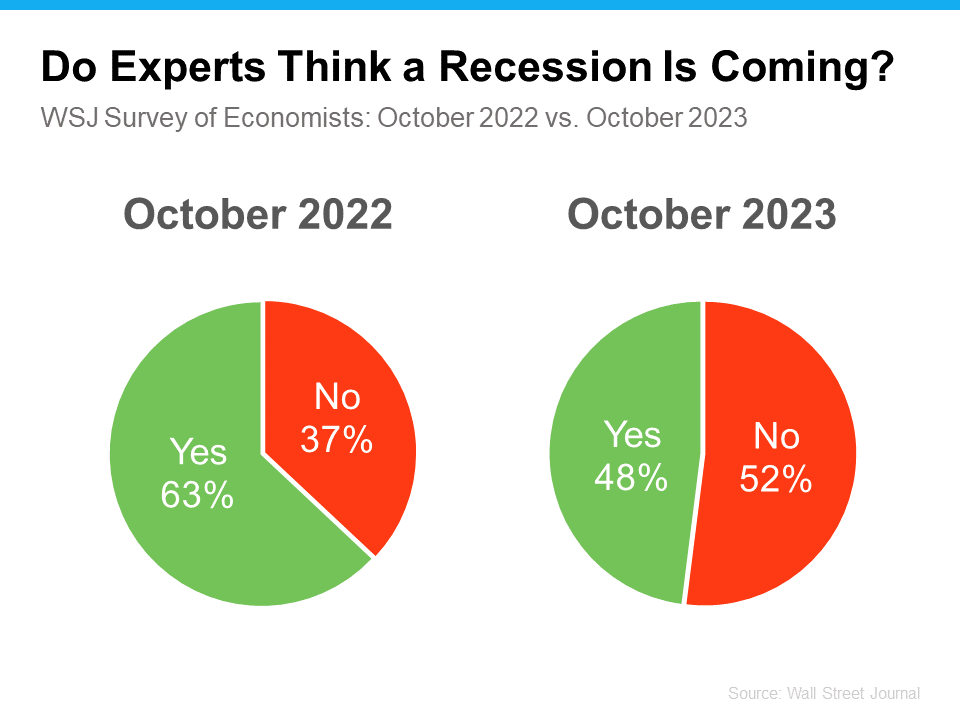

The Wall Street Journal (WSJ) polls experts on this topic regularly. And last year at this time, most of them thought a recession would have happened by now. But as experts look at all the leading indicators today, they’re changing their minds and saying a recession is getting less and less likely. The latest results show that more experts now think we’re not headed for another recession (see chart below):

This is big news for the housing market. And while the 48% to 52% split may seem close to half and half, the key thing to focus on is that the majority of these experts think we’ve avoided a recession already.

Bottom Line

The big takeaway? The data shows there isn’t cause for concern – there are actually more signs of hope. Let’s connect to talk more about the housing market questions on your mind as we head into the new year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link