Why You Need a True Expert in Today’s Housing Market

The housing market continues to shift and change, and in a fast-moving landscape like we’re in right now, it’s more important than ever to have a trusted real estate agent on your side. Whether you’re buying your first home or selling once again, it’s mission critical to work with an expert who can guide you through each unique step of the process.

The reality is, not all agents operate the same way. To truly make a powerful and confident decision as you buy or sell a home, you need a real estate expert who uses their knowledge of what’s really happening with home prices, housing supply, industry projections, and more to give you the best possible advice. Someone who can provide clarity and trust like that is essential to your success. Jay Thompson, Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Unfortunately, when information in the media isn’t clear, it can generate a lot of fear and uncertainty for consumers. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You can lean on an expert to help you separate fact from fiction and get the answers you need.

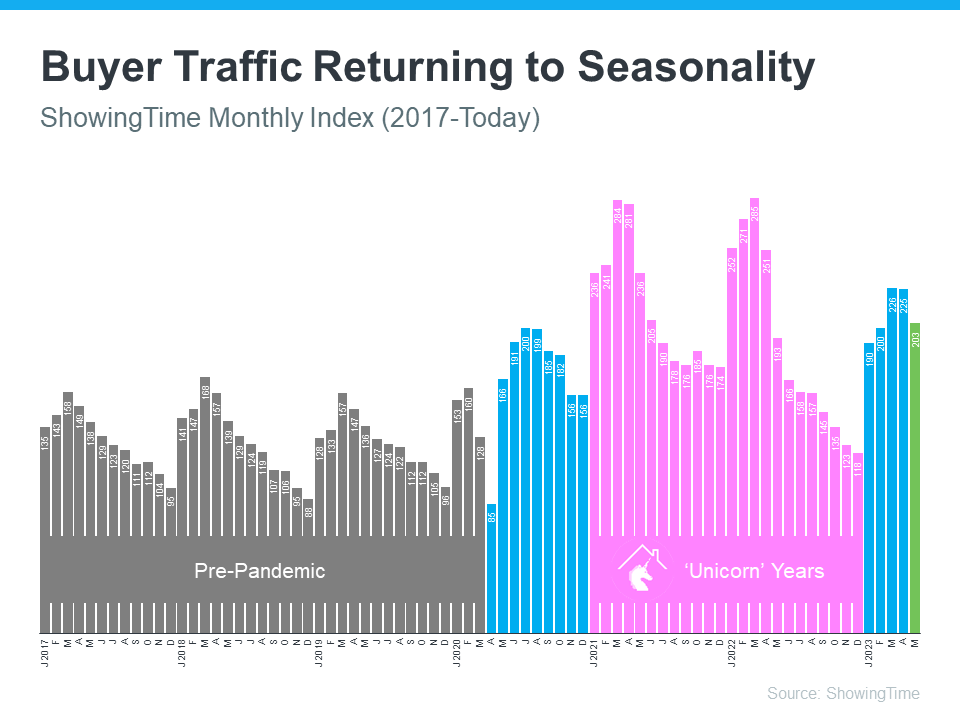

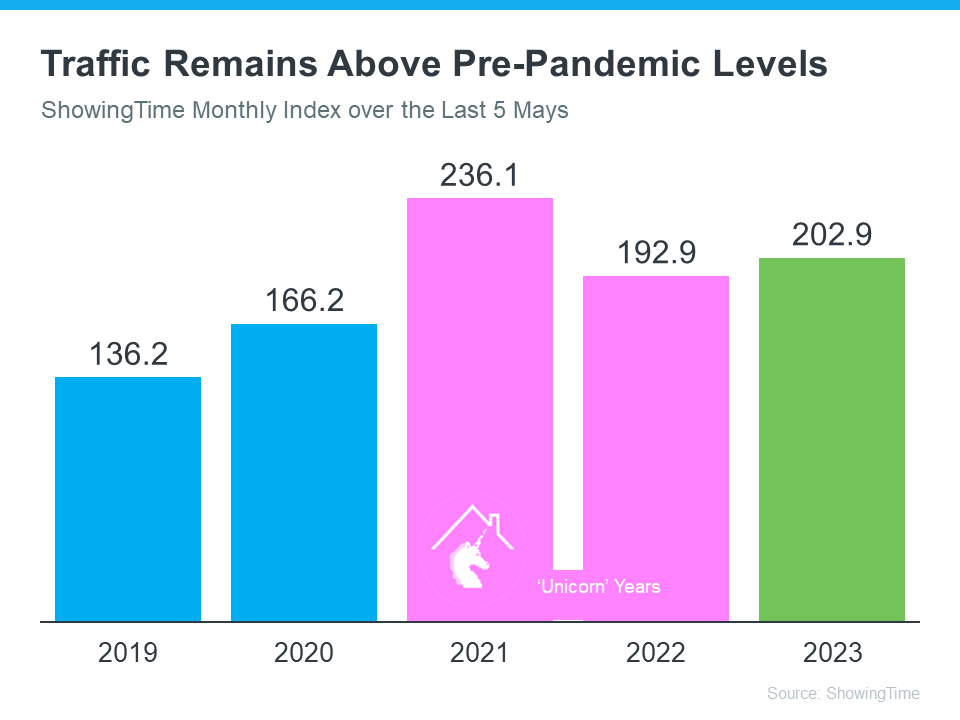

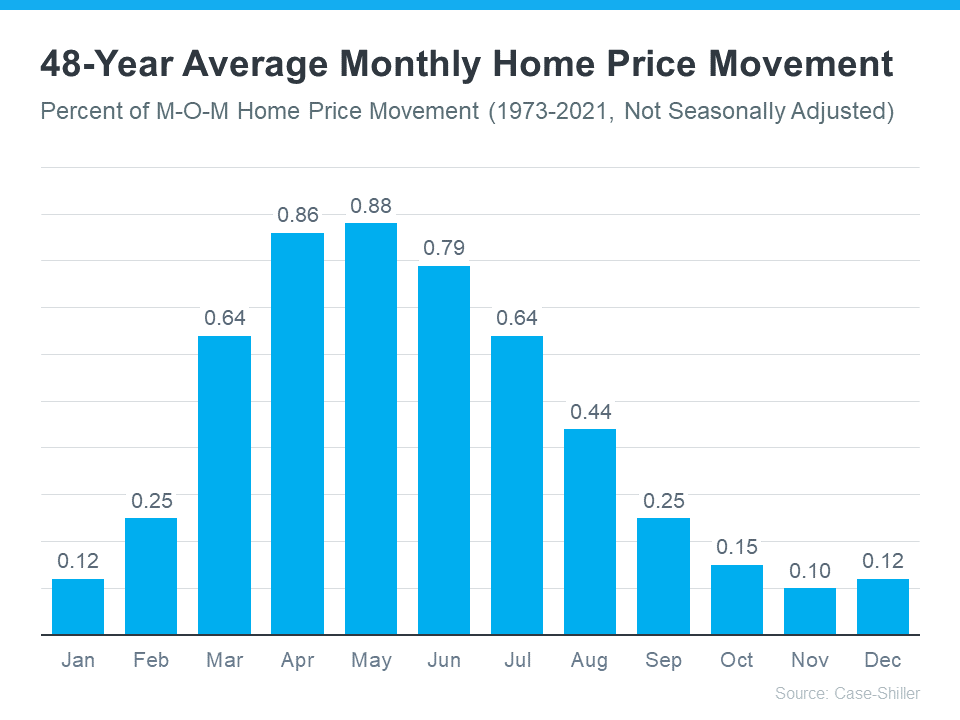

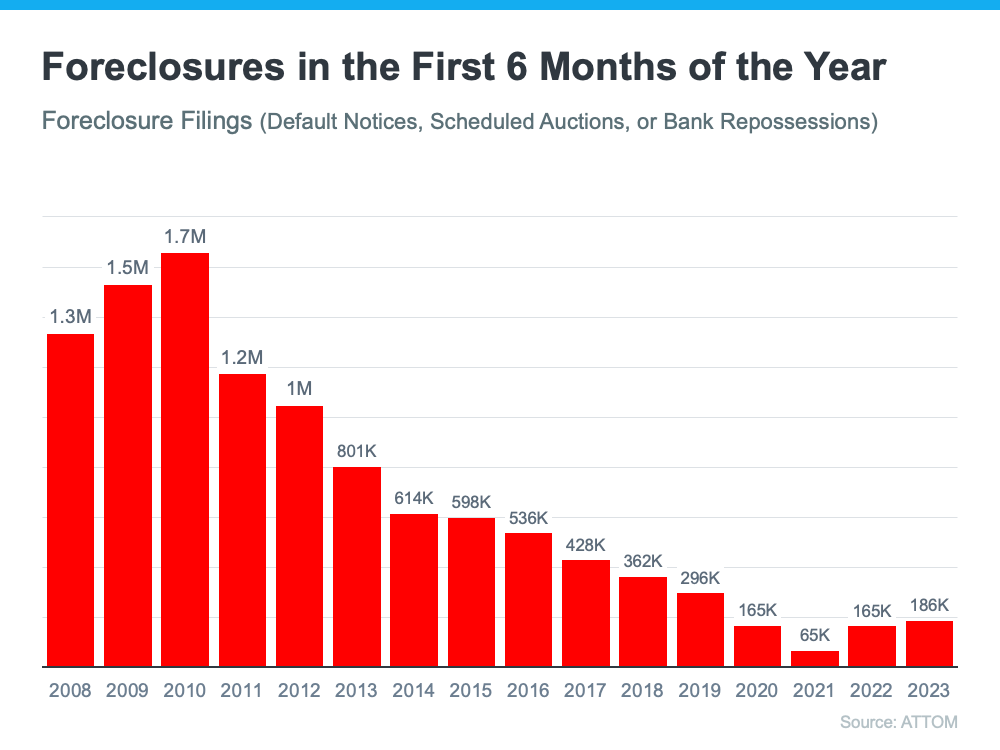

The right agent can assist you in figuring out what’s going on at the national level and in your local area. They can debunk headlines using data you can trust. Experts have in-depth knowledge of the industry and can provide context, so you know how current trendscompare to the normal ebbs and flows in the housing market, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Bottom Line

If you want sound advice and trusted information about our local housing market, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link