More people are taking steps to buy a home. And, if you’ve been waiting for the right time to move, this may be the sign you’ve been looking for.

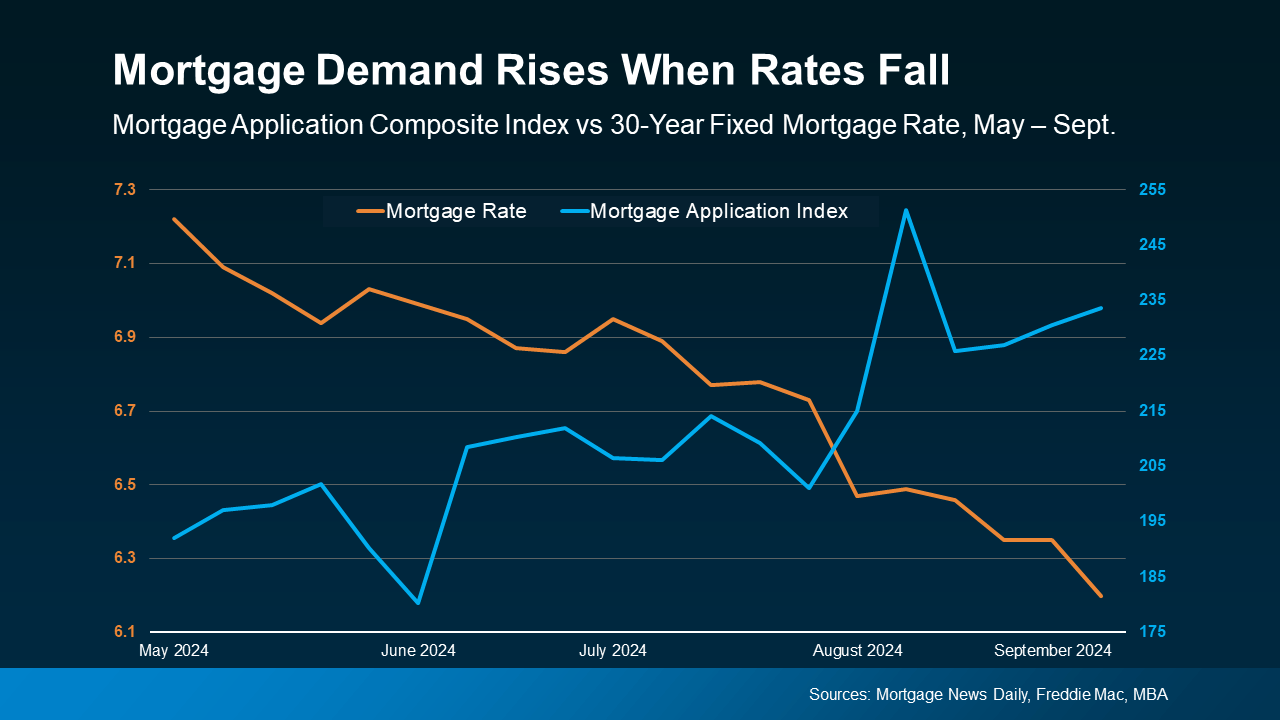

For the past few years, a lot of would-be homebuyers hit pause on their plans. With rising mortgage rates and affordability challenges, buying just didn’t seem doable. But now, more of them are getting back out there. That’s because they’re getting used to the fact that this may be the new normal for the market – especially as forecasts show mortgage rates may be starting to stabilize. According to the National Association of Realtors (NAR):

“Home buyers seem to be getting over the shock of mortgage rates in the mid- to upper-6% range.”

And that’s good for you and your plans to sell. While there isn’t going to be a big rush of buyers flooding the market all at once, this does mean motivated buyers are re-starting their searches. And here’s the data to prove it.

3 Signs Buyers Are Ready To Make Their Move

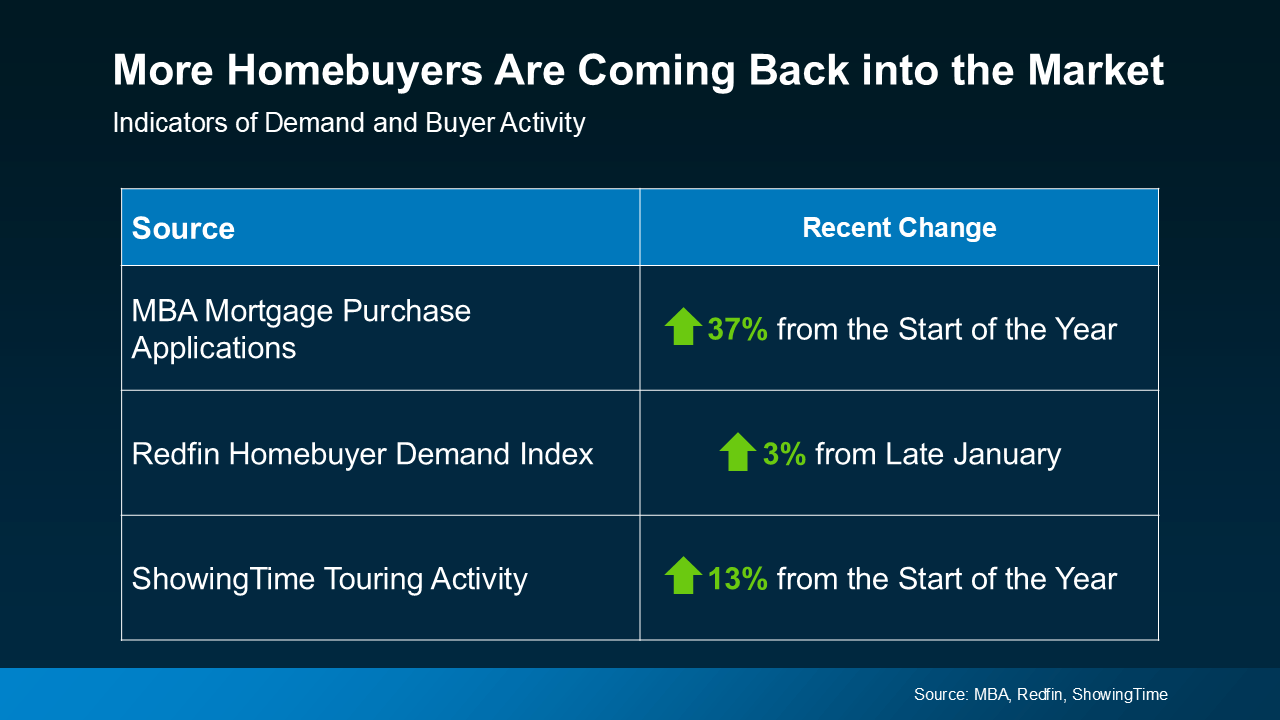

1. Mortgage Applications Are on the Rise: According to the Mortgage Bankers Association (MBA), mortgage applications are up 37% since the start of the year. That’s a big jump and a clear sign more buyers are more active lately. Don’t miss out on that. Serious buyers who are getting their finances in order are great potential buyers for your house.

2. Buyer Demand Is Picking Up: The Homebuyer Demand Index from Redfin shows demand is up 3% since late January. While that’s not a huge spike, momentum is building.

3. More Home Showings: ShowingTime data says home showings are up 13% since the beginning of the year. This added foot traffic is exactly what you want to see if you’re about to sell your house. It signals more serious interest in buying. More buyers out there looking means more potential eyes on your house. And more eyes could translate to more offers.

And chances are, this activity is only going to pick up from here. We’re headed into the busiest season of the year for housing. Spring is when more people choose to buy or sell than any other time of year. So, now is a great time to list and get in on the action.

Bottom Line

As buyers re-enter the market, you have the chance to do the same thing. And the increase in buyer activity is definitely something you’ll want to take advantage of. To make sure your house gets in front of these motivated buyers, let’s connect.

If the right buyer walked through your door tomorrow, would you be ready to sell?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Thinking about buying a home with a friend? It can be a smart, cost-effective way to enter the housing market, but it requires planning. Here’s what you need to know before going halves on a home:

Thinking about buying a home with a friend? It can be a smart, cost-effective way to enter the housing market, but it requires planning. Here’s what you need to know before going halves on a home: